Your Commercial Lender

“Empowering Growth-Funding The Future”

Quick, Reliable, and Flexible Loans Tailored to Your Needs

200

Satisfied Customers

$15M

Loans Funded

About Us

Your Trusted Partner in Financial Growth

We’re committed to helping businesses of all sizes achieve their financial goals. With personalized lending solutions, transparent processes, and a customer-first approach, we aim to provide the support you need to succeed.

Our Mission

We strive to empower our customers with accessible and flexible financial solutions. By prioritizing your needs and goals, we ensure every step of the lending process is straightforward, transparent, and tailored to you.

Why Choose Us

With years of industry experience, a dedicated team, and a focus on trust, we stand out as your dependable financial partner. From competitive rates to quick approvals, we work hard to make lending stress-free and accessible for all.

Our Commitment

Your success is our priority. We are dedicated to delivering exceptional customer service, innovative solutions, and a secure lending experience you can rely on for every stage of life.

Our Services

Tailored Lending Solutions to Meet Your Needs

We offer a range of flexible and accessible loan options designed to fit your unique financial goals. Whether for personal, business, or emergency needs, we’ve got you covered with simple and stress-free solutions.

Flexible solutions to acquire or lease the equipment needed for your business operations.

Short-term financing to manage cash flow, payroll, or other operational expenses.

Financing for purchasing, renovating, or refinancing commercial properties.

Customized loan options to help small businesses grow and succeed.

Turn unpaid invoices into immediate cash to improve liquidity.

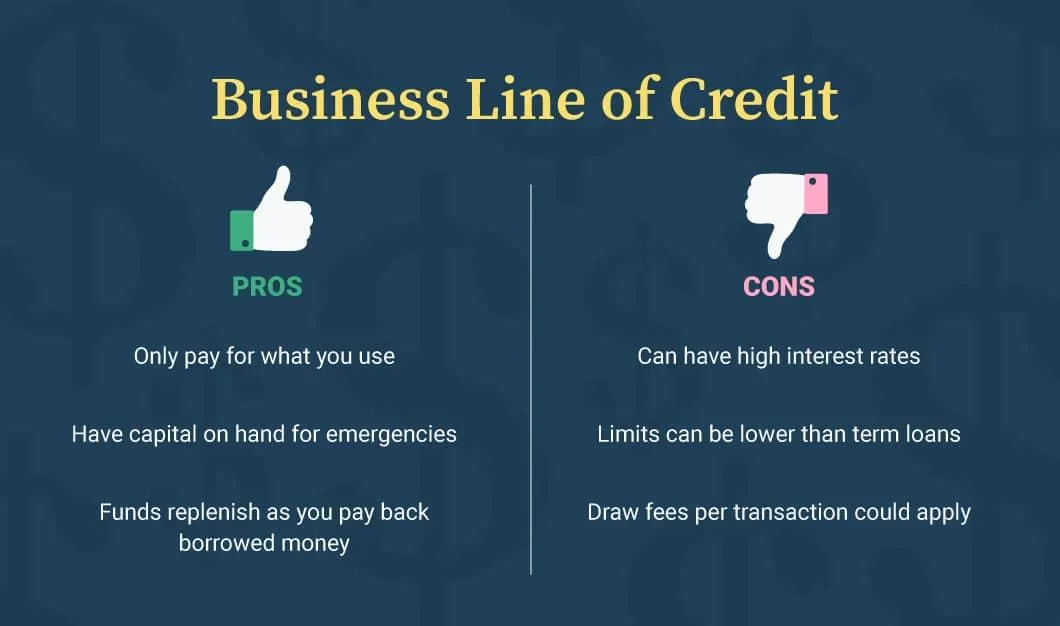

Access flexible, revolving credit to address your business’s ongoing financial needs.

Funding solutions to cover the costs of new construction or major renovations.

Loans secured by your business assets, such as inventory or accounts receivable.

Short-term funding to bridge the gap between financing needs and long-term solutions.

Our Expertise

Transforming Financial Success with Expertise and Personalized Lending Solutions

Our team of financial experts is dedicated to empowering businesses with tailored lending solutions that address unique financial goals. By providing innovative strategies, we aim to simplify complex financial processes and ensure sustainable growth and stability for our clients.

Advantages of Choosing Our Financial Lending Services

Experience a new level of financial flexibility and support with our personalized lending services. Whether you aim to grow your business, secure your future, or manage risks, our expertise ensures that your journey is smooth, efficient, and rewarding.

Customized Loan Plans

Simplified Approval Processes

Comprehensive Risk Management

Expert Financial Guidance

Testimonial

Genuine Reviews From

Satisfied Customers

AOCC Lending made securing a loan for my new venture seamless. Their professional approach and expert guidance helped me make confident decisions every step of the way. I couldn't have asked for a better lending partner.

Johnathan Smith

Entrepreneur, USA

I had a great experience with AOCC. Their website was easy to use, the loan process was fast and straightforward, and the customer support was excellent. They made securing funding for my business simple and stress-free. I highly recommend them to anyone looking for reliable commercial lending services!

Sophia Martinez

Global Investor, Spain

Frequently Asked Questions

Common Business & Finance

Questions And Answers

What is a commercial loan?

A commercial loan is a type of financing designed to help businesses cover expenses such as equipment, real estate, working capital, or expansion.

How do I apply for a commercial loan?

Start by submitting an application with details about your business, financials, and loan purpose. Supporting documents like tax returns and bank statements are typically required.

What can I use a commercial loan for?

You can use it for purchasing property, upgrading equipment, covering operational costs, refinancing debt, or funding growth opportunities.

What qualifications do I need to meet?

Qualifications vary by lender, but key factors include your credit score, business financials, revenue history, and ability to repay the loan.

How long does the loan approval process take?

Depending on the loan type and lender, approval can take anywhere from a few days to a few weeks.

Do I need collateral for a commercial loan?

Some loans require collateral, like equipment or real estate, while others, like unsecured loans, do not.

What types of commercial loans are available?

Options include SBA loans, equipment financing, working capital loans, lines of credit, and commercial real estate loans, among others.

What interest rates can I expect?

Interest rates vary based on loan type, term length, and your credit profile. Rates are typically competitive and tailored to your financial situation.

Can I get a loan if my business is a startup?

Yes, some lenders offer startup financing, but you may need a solid business plan and personal creditworthiness.

How much can I borrow with a commercial loan?

Loan amounts depend on the type of loan, your business needs, and your financial qualifications, ranging from thousands to millions of dollars.

Do I need good credit to get approved?

While good credit helps, some lenders specialize in working with businesses that have less-than-perfect credit.

What happens if I can’t repay the loan?

If you default, the lender may seize collateral (if applicable) or pursue legal action. It’s important to discuss repayment options with your lender if challenges arise.

Can I refinance an existing commercial loan?

Yes, refinancing is available to help you secure better terms, lower interest rates, or additional funds.

Are there upfront costs for a commercial loan?

Some loans may have fees, such as origination fees or appraisal costs. Be sure to review terms carefully before committing.

How do I get started??

Contact us at Alpha-Omega Commercial Capital to discuss your business goals. Our team will guide you through every step of the process!

At AOCC, we are committed to providing trusted financial solutions that empower you to achieve your goals. Our dedicated team is here to guide you every step of the way, offering personalized lending options that fit your unique needs.

Quick Links

Contact Us

Legal

© Alpha Omega Commercial Capital 2026 All Rights Reserved.